There are hundreds of signals and

clues being revealed to us constantly through price action on the charts. Some Forex signals are single candles, some are multiple candle combos, but all are recording price action through their reactions to various conditions. Everything that price does means

something – even when it does nothing.

How we interpret these clues is what gives us the edge in our trading

decisions. Today, I am going to discuss the

most common single-candle reversal signals, that when used in the right context will help to guide your

trades and provide you with low-risk/high-reward opportunities.

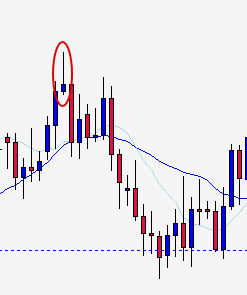

Reversal Signals have many names, but don’t let that confuse or intimidate you

- they're actually pretty simple to identify and interpret. First we are going to look at what is commonly known as the pin bar. These single-candle

signals have a long tail or "wick" (on one side only) with a short body and little to no wick on

the other side; this body type means that price attempted to move in a particular direction and reversed. These candles point out a change in momentum and often occur at turning points. By pairing these

signals with other factors present in the chart, you can increase the

likelihood that you are identifying low-risk, high-reward opportunities in your

trade decisions. Now let’s look at the

specific types, below:

The Shooting Star

This candle sits atop a hill. Notice how the opening price and the closing

price are very close to each other, but the candle has a long wick at the

top. This is a bearish rejection candle,

because price tried to go up and was driven back down (indicating strong bearish

pressure). Also, notice how there is a

gap in between the bottom of the rejection candle and the underlying EMAs. When price is extended too far from the EMAs,

there is pressure on it to pull back towards the mean. This easily identifiable reversal candle was

a good signal and in the proper context.

Price plummeted the next day, retested a few days later, and then dropped like a rock all the way

to the support level below.

The Inverted Hammer

The Inverted hammer looks just like the shooting star except that it occurs in a trough or valley during a trend. These rejection candles are

actually signs of a (bullish) potential reversal. So, even though the price move up was driven back down - the fact that it attempted to move up aggressively in the first place is what signals weakness in the trough and that price may soon climb sharply. This makes sense since they are showing signs

of weakness to moving down. Think of it this way: in the chart segment above, we have an uptrend; the circled inverted hammer happens during the trough or valley of price action when price is just consolidating and moving side-to-side, when we see that pin bar we know that the buyers are trying to drive price up (which is in align with the trend direction anyway).

The Hammer

Picture this candle hanging from the bottom of a trough (they say in the biz that it is "hammering out a bottom"). It also looks like a hammer, with it's long wick falling below the surrounding candlesticks.

It is the opposite of the shooting star and acts in the same way except

that it indicates strong bullish pressure.

In this example, we see that price has broken below a support level, but

the hammer candle tells us that there is strong buying pressure and that price

will not continue downward (at least in the immediate future). Experienced traders know that when they see

this signal, price is likely to come up and test the resistance level (which previously provided support) – and

it will either hold as resistance (price remains below this level) OR it will

break through the resistance and the level will again act as support (as it did

in this case). However, we must be

careful when attempting to trade near or through strong support/resistance levels, because where

there was previously strong support – we may now find strong resistance. Even though this appears to be a failed break

of the support level – traders should look for continued signals before

deciding what price is most likely to do next.

If price were to rise up to the resistance level and print a strong

bearish rejection candle (picture a shooting star piercing the resistance

level) THEN that would indicate that the bears are still in control. Instead, in this example we see a couple

small indecision candles just above the s/r line. This is not convincing enough in my opinion

and the trader should sit back and wait for further price action signals before

making any decisions. This is what is

meant by proper “context”, and this signal lacks it I believe.

The Hanging Man

Hanging Man: The hanging

man is the opposite of the inverted hammer signal; but operates in the same

manner. In this example, we have two

small hanging man candlesticks that touch the level of resistance above, but do

not “break-through” it. Notice that the

wicks of these candles are respecting the 10-day EMA just below them. Then, we have a larger hanging man whose wick

pierces the 10-day EMA deeply. Remember,

these long wicks are showing us that there is repeated bearish pressure (though

it failed initially). Even though price rose back up to test this resistance

level again after the hanging man candles, its continued failure to break

through this level is further indication that the bears are still in control –

and indeed we see a sharp sell-off directly following which drives price all

the way down to the next significant support level below. Even

before we are given the hanging man signals, we see a failed attempt to break

through the level by a powerful bull candle – again further evidence that the

bears are in control and the level will not be breached.

In the examples above, I have pictured traditional "pinbar type" candlesticks that are showing a price reversing; however, the concept is somewhat flexible. Many times, you will see candles with larger bodies (aboout 50%) that are reversal signals as well candles as well. The position of the candle and size of the price rejection are far more important than the "perfect pin bar body". In the chart below we see some other examples of what a rejection candle might look like:

.png)

No comments:

Post a Comment