There's a common saying in trading circles, that "the trend is your friend". This is true, it is safest to trade in the direction of the predominant trend (if one exists). Even though 'the trend is your friend', traders will learn that riding a trend takes patience and a lot of bravery to make it through retracements profitably. But why does price retrace, consolidate and stall? It would be nice if you were able to enter a trend at the bottom and price steadily climbed to the "top". But it doesn't, price stair-steps, it goes in waves, it shoots up and then back down again, or maybe moves sideways for extended periods of time.

Because people are trying to ride a trend (or take advantage of volatility), when they see price moving they tend to jump on board which gives the trend continued momentum (whether it is bullish or bearish momentum, in forex it doesn't matter, as long as price is moving we can make money on it) - that is why it is safest to trade in the direction of the trend. Sometimes, however, price takes a break (consolidates in the side-to-side pattern, flag patterns, etc.), or sometimes it retraces. Retracements happen when selling pressure temporarily exceed buying pressure in a bullish trend, or vice versa. Especially at important support/resistance levels, you will see price falter and possibly reverse, because people are always trying to pick a "top" or "bottom" of a trend. However, if the momentum of the trend is too strong, price will overcome the retracement and continue along it's original path.

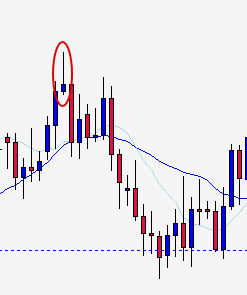

Let's look at some examples:

In the EURUSD Weekly chart above, we see a bullish trend from about June 2013 Until around May 2014, which then transitions to a bearish trend.

Most people don't trade off of the weekly chart, I am just using it here to see the big picture more clearly. Let's pretend though that we were fortunate enough to buy at around point 1. This would place us right at the bottom of this bullish trend (the best entry possible). A long-term trader might stay in that trade all the way to the top. Heck, in a perfect world you would cash out at the double top and then place your sell order and ride it back down (the ride down is usually more exhilarating with less scary backtracking!)

But keeping it in perspective here, it's not as if you knew at point 1 that a large trend was about to play out. At point one, there is no clear direction established. Imagine how brave you would have to be at point 2 to stay in the trade, when you have lost 50% of your gains since point 1. Keep in mind as well that this is the weekly chart, so this pain is extended over a three week period of seeing you profits decrease. Could you stand that? Most traders can't, and that is why I believe that scalping and swing trading are far more popular, rather than staying in one trade for the entire time. I find that most forex traders are 'in and out' of trades within the day, or a few days at most. So, most people are not entering at the bottom and holding a trade all the way to the top on a weekly chart, but these same patterns are present on the lower time frames as well, and the same mental discipline is required to handle these retracement situations properly.

It helps if you understand the typical movement of price and price patterns (from level to level) and the way retracements work. If you did not enter this uptrend at point one, you would want to shoot for the retracements (dips or valleys) labeled 2, 3, or 4 for your next entry (that way you are getting the best entry price). Or, alternatively, if you were trying to catch the down trend, you would try to put in your sell order at a peak (where buyers temporarily take control), which would get you the best selling price. This was harder to do in this example due to the strength of the bearish move. Another thing to consider is that if you are a long-term trader or you are just staying in a trade to try to catch as much of a trend as possible - you could add to your position at these points, and move your stop loss up as you go (remove risk from first trade, add second trade). In this way, you could stack your profits quickly.

The last thing I would like to point out is the end of the chart. I have drawn a large retracement here, just to illustrate that after a large sharp drop in price, a large retracement is likely to occur if that support level holds.

A few examples of patterns mentioned above

and a pennant flag pattern:

.png)